Table of Contents

Setting up parameters for trading XAUUSD (Gold) can be pivotal due to its volatility and sensitivity to global economic news. Here’s a guide on configuring entry, take profit (TP), stop loss (SL), break-even (BE), and exit strategies, along with general advice:

1. Entry Parameters:

- Signal Confirmation: Use multiple indicators for confirmation, such as a combination of a trend indicator (e.g., Moving Average or Kaufman Efficiency Ratio) and a momentum indicator (e.g., RSI or CCI).

- Timeframes: Focus on the main timeframe (e.g., H1 for execution) and a higher timeframe (e.g., H4) for trend confirmation.

- Volatility Filter: Apply ATR or Bollinger Bands to avoid entries during low-volatility periods when Gold often consolidates.

- Breakout Strategy: Consider entries above/below recent highs/lows or breakout levels using Super Trend or Donchian Channels.

2. Take Profit (TP) Setup:

- Fixed TP Levels: Set TP levels at 2-3 times the ATR value or use Fibonacci extensions (e.g., 161.8% or 261.8%) to target strong price levels.

- Dynamic TP: Implement a trailing TP based on a percentage of price movement (e.g., 1-2% daily move in XAUUSD).

- Partial Profit Taking: Lock in partial profits at the first TP level (e.g., 1:1 RRR), while letting the remaining position run to maximize gains.

3. Stop Loss (SL) Placement:

- ATR-Based SL: Set stop losses at 1.5x-2x the ATR to allow for natural price movement and prevent early exits during typical gold fluctuations.

- Support/Resistance SL: Place SL just beyond major support or resistance levels identified by pivot points or Fibonacci retracements.

- Technical Patterns: Ensure SL is positioned outside significant chart patterns (e.g., triangles or channels) to confirm validity.

4. Break-Even (BE) Strategy:

- Threshold BE: Move SL to breakeven after price moves in your favor by a certain percentage (e.g., 0.5%-1% of the price).

- Volatility-Adjusted BE: Adjust the break-even point based on current ATR to avoid being stopped out prematurely during high volatility.

- Two-Step BE: Initially move the SL to breakeven after a moderate profit (e.g., 1 ATR). As the trade progresses, trail the SL based on new ATR readings or key levels.

5. Exit Strategy:

- End-of-Day Exits: Close positions before key market events or the end of the trading week to avoid overnight gaps and weekend volatility.

- Time-Based Exits: Set a maximum holding period (e.g., no more than 5 days) to reduce exposure to unexpected market changes.

- Signal-Based Exits: Use a trailing indicator like the Parabolic SAR or Super Trend for signal-based exits when the trend reverses.

- Multi-Condition Exits: Combine exit signals from indicators such as RSI (overbought/oversold) and CCI divergences for a robust exit plan.

6. General Advice:

- Risk-Reward Ratio (RRR): Maintain an RRR of at least 1:2 or greater for each trade to ensure long-term profitability.

- Volatility Considerations: Gold is sensitive to economic releases like U.S. Non-Farm Payrolls, CPI data, and FOMC meetings. Plan around these dates by reducing position size or closing trades to manage risk.

- Adaptive Position Sizing: Use a volatility-based position sizing model (e.g., ATR-adjusted) to align trade size with current market conditions.

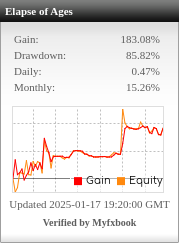

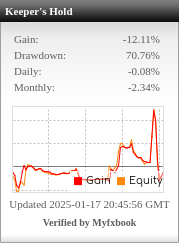

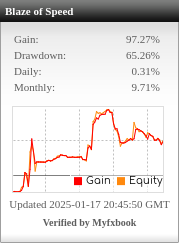

- Backtesting and Optimization: Use StrategyQuant X to test the strategy over long periods and different market cycles, ensuring robustness.

- Portfolio Approach: Consider pairing your Gold strategy with other correlated and non-correlated assets to spread risk and smooth out performance.