To help you optimize for the FTMO challenge, here are detailed points addressing your questions:

- Daily Loss Limit (5%):

- Trade Sizing: Structure your trade sizes so that no single trade or group of trades taken on the same day exceeds 2-3% of the account. This buffer can help you stay within the 5% limit even in the worst-case scenario.

- Stop Loss Placement: Always use stop losses to cap the potential loss on each trade. Ensure that cumulative risk from open positions stays well within the daily loss limit.

- Limit Daily Exposure: Use a daily trading plan that sets a cap on the number of trades or risk exposure for the day, helping prevent overtrading.

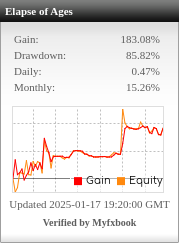

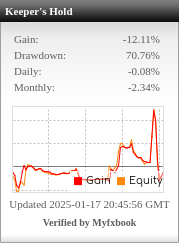

- Maximum Drawdown (10%):

- Portfolio Diversification: Build a diversified strategy set to spread risk across uncorrelated assets or strategies.

- Regular Monitoring: Use SQX to simulate and monitor drawdown patterns during backtesting and select strategies with a maximum drawdown comfortably below the 10% threshold.

- Adaptive Stop Loss: Implement dynamic stop losses or trailing stops that adjust based on market volatility to protect gains and reduce drawdown.

- Risk Management:

- Fixed Fractional Position Sizing: Risk a fixed percentage (e.g., 0.5%-1%) of your account on each trade to limit potential losses without stifling profit potential.

- Break-Even Stops and Trailing Stops: Use break-even stops to remove risk after a trade moves in your favor and trailing stops to lock in profit as it continues.

- Multiple Timeframe Analysis: Use higher timeframes for trend direction and lower ones for entry, optimizing entry points and reducing the chance of high drawdowns.

- Consistency:

- Robust Backtesting and Optimization: Use SQX to test strategies across various time periods and ensure they perform consistently, not just in one market condition. Utilize out-of-sample testing to confirm stability.

- Trade Filters: Apply filters based on volatility, trend strength (e.g., ADX or Moving Average slopes), or other market conditions to prevent trading in suboptimal periods.

- Maintain Simplicity: Avoid overfitting by keeping strategy rules straightforward and logical.

- Adapting to Different Market Conditions:

- Volatility-Based Adjustments: Incorporate volatility measures such as ATR to adapt stop loss and take profit levels according to market conditions.

- Multi-Strategy Approach: Combine trend-following, mean-reversion, and breakout strategies to cover various market phases.

- Monitoring Correlations: Regularly check correlations between strategies or instruments to avoid compounding risk when market conditions change.

- Position Sizing:

- Dynamic Sizing: Adjust position size based on current account equity and market volatility. This can be done using ATR-based sizing to ensure that each position aligns with your risk tolerance.

- Scaling In and Out: Gradually scale into trades to mitigate entry risk and scale out to lock in partial profits, balancing risk and reward.

- Stop Loss Placement:

- ATR-Based Stops: Use a multiple of ATR (e.g., 1.5-2x ATR) to set a stop loss that adapts to current market volatility, allowing enough room for price fluctuations.

- Technical Levels: Place stops beyond key support/resistance or Fibonacci levels to avoid being stopped out prematurely.

- Time-Based Stops: Consider using time-based exits in combination with price-based stop losses to limit exposure during uncertain market periods.

These strategies and tips can help you meet FTMO’s trading rules while optimizing for profitability and risk management.