When retesting strategies from XAUUSD on a new pair like AUDUSD, you should first consider retesting with the original parameters before adjusting them. Here’s why, and the next steps if adjustments are needed: Initial Retesting Without Adjustments: Purpose: This helps you identify which strategies are naturally robust and can perform well across different currency pairs

Space Time...

-

-

In trading, experience is your greatest teacher, but only if you learn from it. Keeping a detailed trading journal is an essential tool for growth and consistent improvement. Without proper records of your trades, it becomes nearly impossible to identify patterns, correct mistakes, or replicate successes. A well-maintained trading journal helps you document not just

-

Trading success demands a mindset rooted in adaptability rather than stubbornness. As a trader, you must invest your money with intention, not your ego. Even the most meticulously crafted trading system can lead you astray when market conditions evolve unexpectedly. The only constant in trading is change—markets shift, trends fade, and what once worked seamlessly

-

To achieve consistent success in trading, you must start by understanding yourself—your strengths, weaknesses, and emotional tendencies. Self-awareness isn’t just an advantage; it’s the foundation for building a profitable trading career. In fact, mastering your inner world is 97% of what it takes to excel in the markets. Many traders stumble not due to a

-

To adapt your 30,000 XAUUSD strategies to another currency pair like AUDUSD, here’s a breakdown of the best approach for each option: Option A: Retest Explanation: Run the existing XAUUSD strategies on AUDUSD data without changing any parameters. Pros: Quick Validation: Gives an initial indication of which strategies perform well on a different pair. Robustness

-

In StrategyQuant X (SQX), the Trailing Activation and Trailing Stop sections are distinct, each with specific settings: Trailing Activation: Controls when the trailing stop becomes active. By default, Trailing Activation in SQX offers ATR as the primary activation option, meaning the trailing stop is activated once a certain ATR threshold is met. Trailing Stop: This

-

In StrategyQuant X (SQX), setting up trailing stops based on indicators allows you to adaptively protect profits as market conditions change. Here’s a step-by-step guide on how to configure trailing stops that follow indicator levels rather than a fixed price distance. 1. Choose an Indicator for Trailing Activation You’ll want to pick an indicator that

-

In StrategyQuant X (SQX), if you want to activate a trailing stop without relying on a specific timeframe, you can do this by setting up the trailing stop condition based on price movement or indicator levels rather than on a timeframe. Here are a few ways to implement this: 1. Activate Trailing Based on Distance

-

Primary Filters for Portfolio Selection (Including IS and OOS) When building portfolios in Portfolio Master and selecting strategies for long-term stability and profitability, you can use Primary Filters that incorporate both In-Sample (IS) and Out-of-Sample (OOS) testing. This approach will ensure that your portfolios are robust not only in the training phase but also in

-

Suggested Approach for Phase 1 Portfolio Creation with IS and OOS Filtering In phase 1, the goal is to create several robust portfolios by filtering and ranking strategies to achieve high performance and stability, with a specific focus on their behavior in both in-sample (IS) and out-of-sample (OOS) testing. IS and OOS Filtering: IS: Ensure

-

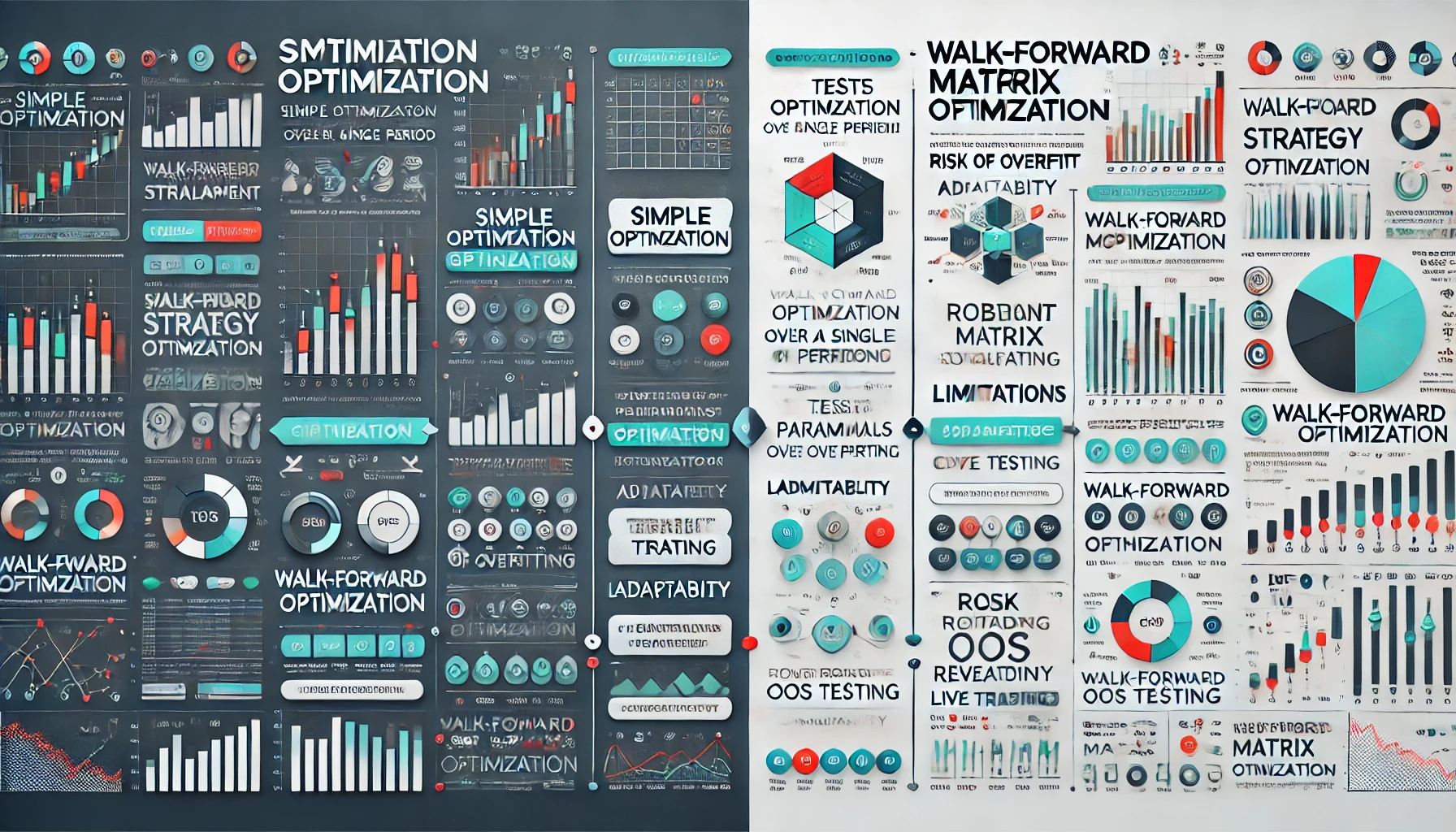

In StrategyQuant’s Optimizer, the Simple and Walk-Forward Matrix optimizations serve different purposes and offer distinct methodologies for testing and optimizing strategies. 1. Simple Optimization Description: Simple optimization tests different combinations of input parameters over a single, fixed in-sample (IS) period. It runs through all the possible parameter combinations within the selected range and finds the

-

Here’s an updated version of unique trading styles using three or more signals from your list. This will increase complexity while combining multiple indicators for cross-confirmation and more refined trading decisions. 1. Volatility Compression Breakout Strategy Concept: Use Choppiness Index, ATR, and Disparity Index to detect volatility compression and breakout potential. This strategy identifies low-volatility

-

Yes, you can incorporate Fibonacci Retracement in your strategy development within StrategyQuant X (SQX), but it will need to be added via custom code or as a part of a custom indicator if it’s not available natively. You mentioned earlier that you’re looking for an alternative or similar indicators that work like Fibonacci Retracement. Here

-

To match your available signals to the 12 strategies, let’s review and count which indicators would be appropriate for each trading strategy from the list of signals you provided. Trading Strategies and Potential Indicator Matches: Price Action Trading Indicators: Candle Pattern, Fractal, Highest Lowest, Moving Average, Bollinger Bands, Fibonacci (custom code possible) Range Trading Strategy

-

For filtering strategies in In-Sample (IS) and Out-of-Sample (OOS) phases, here’s how you should approach it to ensure long-term stability: Filtering by IS and OOS: Both IS and OOS performance are critical, as they provide insight into how the strategy performs in known market conditions (IS) and unseen market conditions (OOS). The goal is to ensure the strategy generalizes well beyond the