To incorporate these elements into your SQX setup for handling maximum drawdown effectively, here are the specific parameters and considerations:

1. Portfolio Diversification:

- Multi-Strategy Approach: In SQX, build and test different strategies that target various market conditions (e.g., trend-following, breakout, mean-reversion). This diversification helps balance drawdowns since each strategy may perform differently during various market phases.

- Asset Selection: Include other assets besides XAUUSD if feasible, such as major currency pairs, to spread risk and reduce correlation.

- Correlation Analysis: Use SQX’s built-in tools to analyze the correlation between strategies. Select a mix with low correlations to ensure the portfolio’s drawdown is less affected by any single market movement.

2. Regular Monitoring:

- Backtesting and Walk-Forward Analysis: Regularly backtest and run walk-forward optimization to see how drawdown patterns evolve over different timeframes. This ensures strategies are resilient and maintain drawdowns below the 10% threshold.

- Out-of-Sample Testing: Test strategies with out-of-sample data to confirm they perform well beyond just in-sample data, helping to validate their robustness in managing drawdown.

- Monte Carlo Simulations: Utilize Monte Carlo analysis in SQX to stress test strategies under various market conditions, identifying those with a consistent maximum drawdown below the desired level.

3. Adaptive Stop Loss:

- ATR-Based Stop Loss: In SQX, configure adaptive stop losses based on a multiple of the ATR (e.g., 1.5x-2x). This makes the stop loss dynamic and better suited to market conditions, allowing trades to have room during high volatility while tightening in calm periods.

- Trailing Stop Loss: Implement a trailing stop loss feature that follows the price as it moves in your favor. Use a percentage of the ATR or a fixed percentage (e.g., 1%) that updates as the price increases.

- Break-Even Adjustments: Set rules for moving the stop loss to break-even after the trade has gained a certain number of pips or a percentage of the ATR. This reduces the risk of a profitable trade turning into a loss.

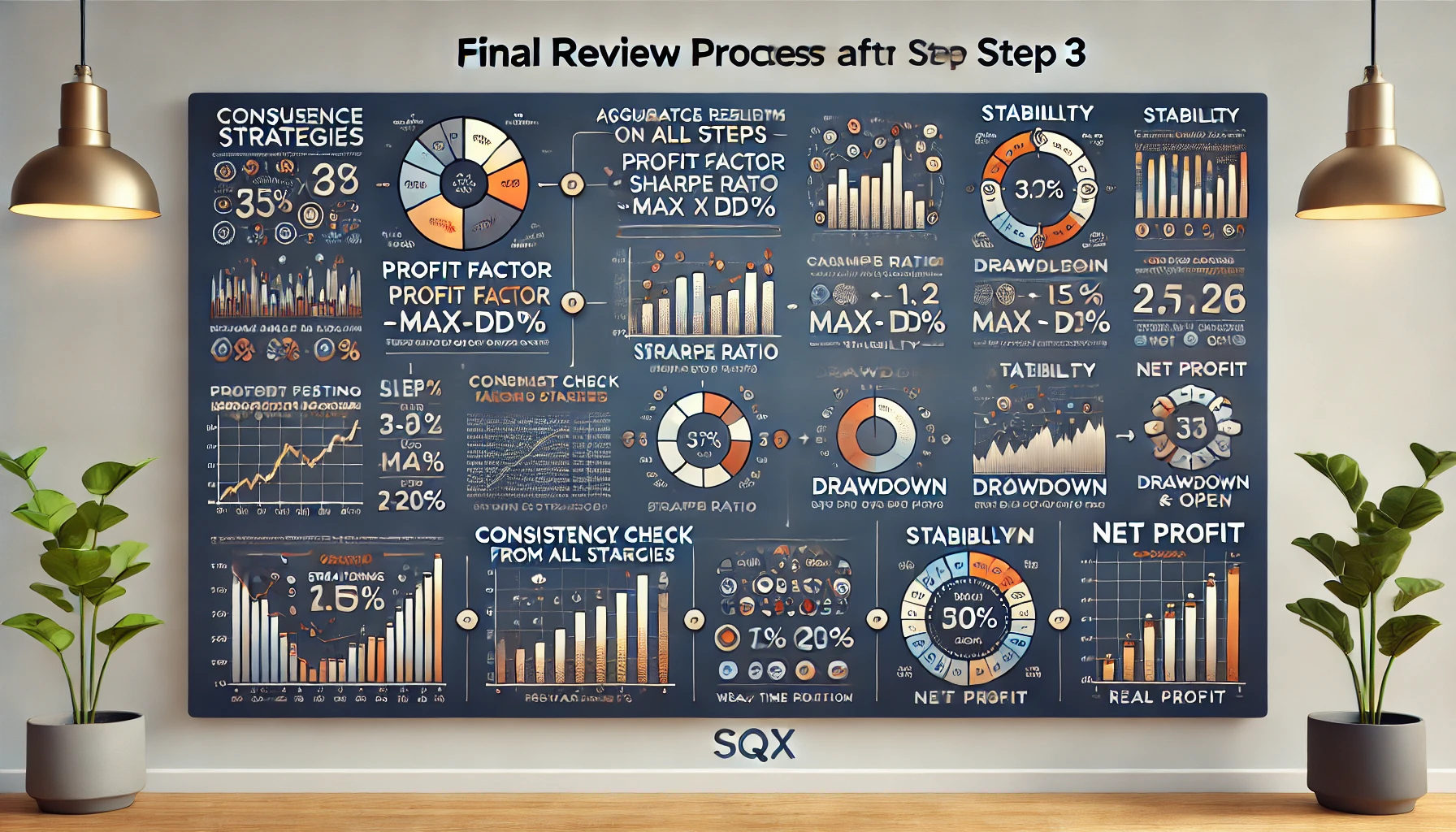

SQX Parameter Settings for Maximum Drawdown Control:

- Maximum Drawdown Filter: Configure the “Max Drawdown” filter during strategy generation to discard any strategy that shows a drawdown over 10% in backtests.

- Risk Control Rule: Add a rule that limits the number of open trades or caps exposure based on total equity or margin.

- Trailing Stop Mechanism: Set up rules in the strategy logic for trailing stops that trigger once a predefined profit threshold is reached (e.g., trailing starts at 1 ATR profit).

- Portfolio Drawdown Limitation: Use SQX Portfolio Master to set an equity stop for the portfolio, ensuring the combined strategies don’t push drawdown above 10%.

By using these techniques and parameters, you create a structured approach to control drawdown effectively, ensuring strategies are optimized for real-world trading and compliant with risk management standards like those required for FTMO.