Yes, when merging strategies into a portfolio in SQX, the global trading options such as “Exit on Friday” or “Limit Trading Range” apply to the merged portfolio as a whole. This means:

- Instrument Consistency:

- You can mix strategies from different instruments (e.g., XAUUSD and AUDUSD), but only if the global trading options make sense across all instruments. If trading behavior (e.g., session times) differs greatly between instruments, it might create conflicts.

- Timeframe Variance:

- You can merge strategies using different timeframes (e.g., M15 and H1). However, the portfolio may become harder to interpret, especially if the global settings (e.g., exit times or trading hours) affect strategies differently across timeframes.

- Strategy Options Alignment:

- If individual strategies have specific settings that conflict with global options (e.g., one strategy relies on no-limit trading hours while another limits trading to the London session), the global options will override these.

Recommendations:

-

If you want to mix different instruments or timeframes, ensure their logic and performance are robust enough to handle global settings.

-

If strategies have critical unique options, avoid merging or build separate portfolios for each configuration.

Mixing different instruments and timeframes can create diversified and robust portfolios, but it must be done carefully to avoid conflicts or inefficiencies. Here’s a structured approach:

1. Key Considerations for Mixing Instruments

- Instrument Correlation:

- Aim to mix instruments with low or negative correlations. For example:

- Good combinations: XAUUSD and AUDUSD (moderate correlation); USDJPY and GBPUSD (low correlation).

- Risky combinations: EURUSD and GBPUSD (high correlation).

- Tools: Use correlation analysis to confirm.

- Aim to mix instruments with low or negative correlations. For example:

- Trading Hours and Behavior:

- Different instruments react to different trading sessions (e.g., XAUUSD active during London/NY, USDJPY active in Tokyo).

- Avoid instruments with conflicting optimal trading ranges unless your global options align with all.

- Cost Structure:

- Ensure that trading costs (spreads, commissions, swaps) don’t disproportionately impact certain instruments.

2. Key Considerations for Mixing Timeframes

- Complementary Timeframes:

- Combine timeframes with complementary behavior:

- Lower timeframes (M15, M30) for capturing short-term trends or scalps.

- Higher timeframes (H1, H4) for broader trends and stability.

- Avoid redundancy (e.g., M15 and M30 strategies doing similar trades).

- Combine timeframes with complementary behavior:

- Position Size & Risk Management:

- Mixed timeframes can increase overlapping trades. Apply portfolio-level position sizing to manage overall risk.

- Execution and Synchronization:

- Ensure your backtesting and execution environment supports smooth transitions between timeframes without timing issues.

3. Portfolio Design Suggestions

Here’s how to structure and balance portfolios with mixed instruments and timeframes:

A. Single-Timeframe, Multi-Instrument Portfolio

- Example: XAUUSD M15, AUDUSD M15, EURUSD M15.

- Advantages: Easier to manage global options since all strategies share the same timeframe logic.

- Challenges: Instruments with highly different characteristics may need different filters/settings.

B. Multi-Timeframe, Single-Instrument Portfolio

- Example: XAUUSD M15, XAUUSD H1, XAUUSD H4.

- Advantages: Focused on a single instrument’s behavior across timeframes. Robust to changes in volatility.

- Challenges: Risk of over-concentration if XAUUSD trends or ranges unexpectedly.

C. Multi-Timeframe, Multi-Instrument Portfolio

- Example: XAUUSD H1, EURUSD M15, USDJPY H4.

- Advantages: Maximum diversification of signals, less exposure to a single market.

- Challenges: Complexity in managing global options and synchronizing trades.

4. Workflow for Building Mixed Portfolios

- Validate Individual Strategies:

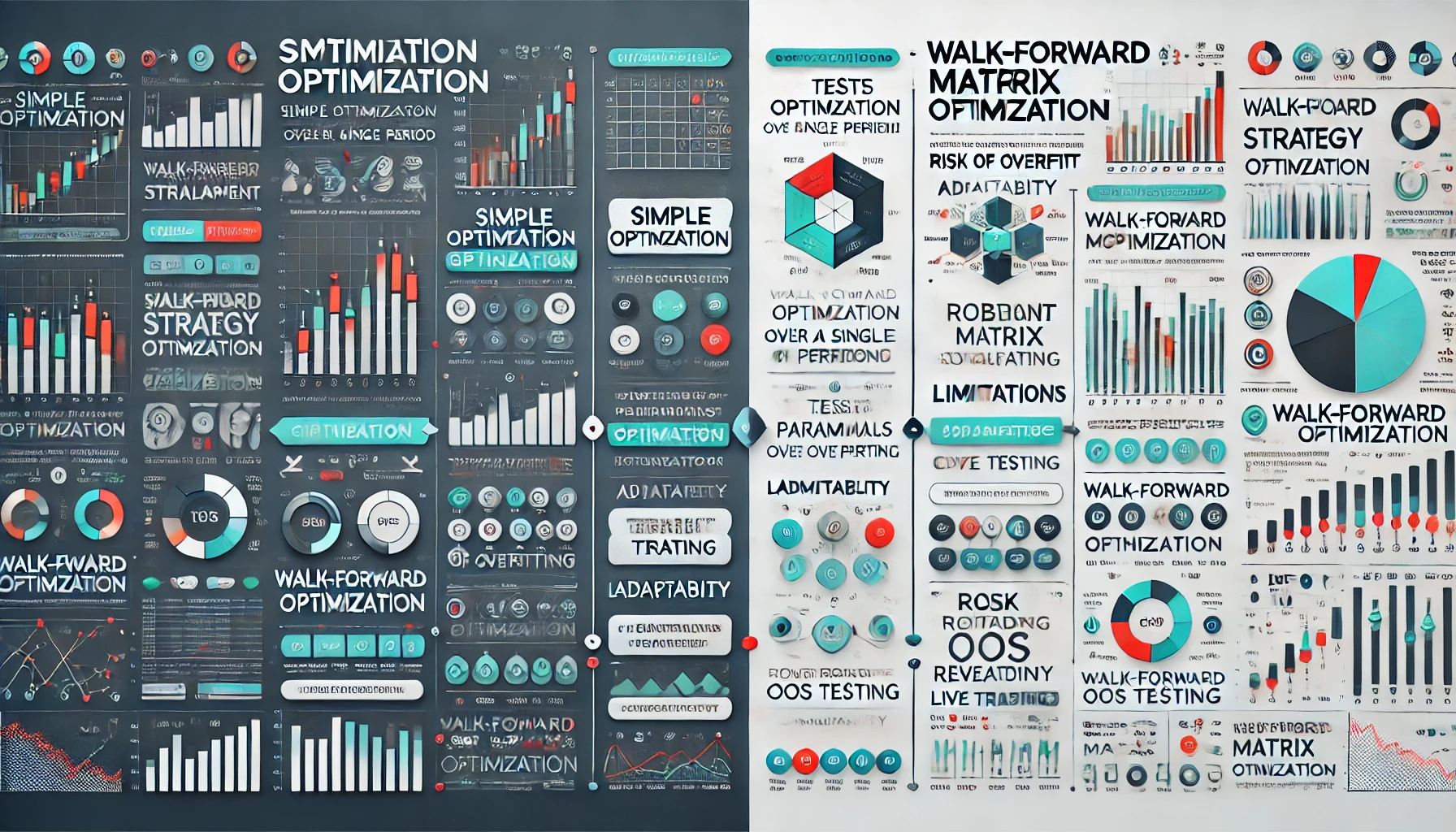

- Test strategies on their respective instruments and timeframes. Use robust walk-forward validation.

- Correlation Analysis:

- Measure historical correlations between strategies’ equity curves, not just instruments.

- Simulate Portfolio:

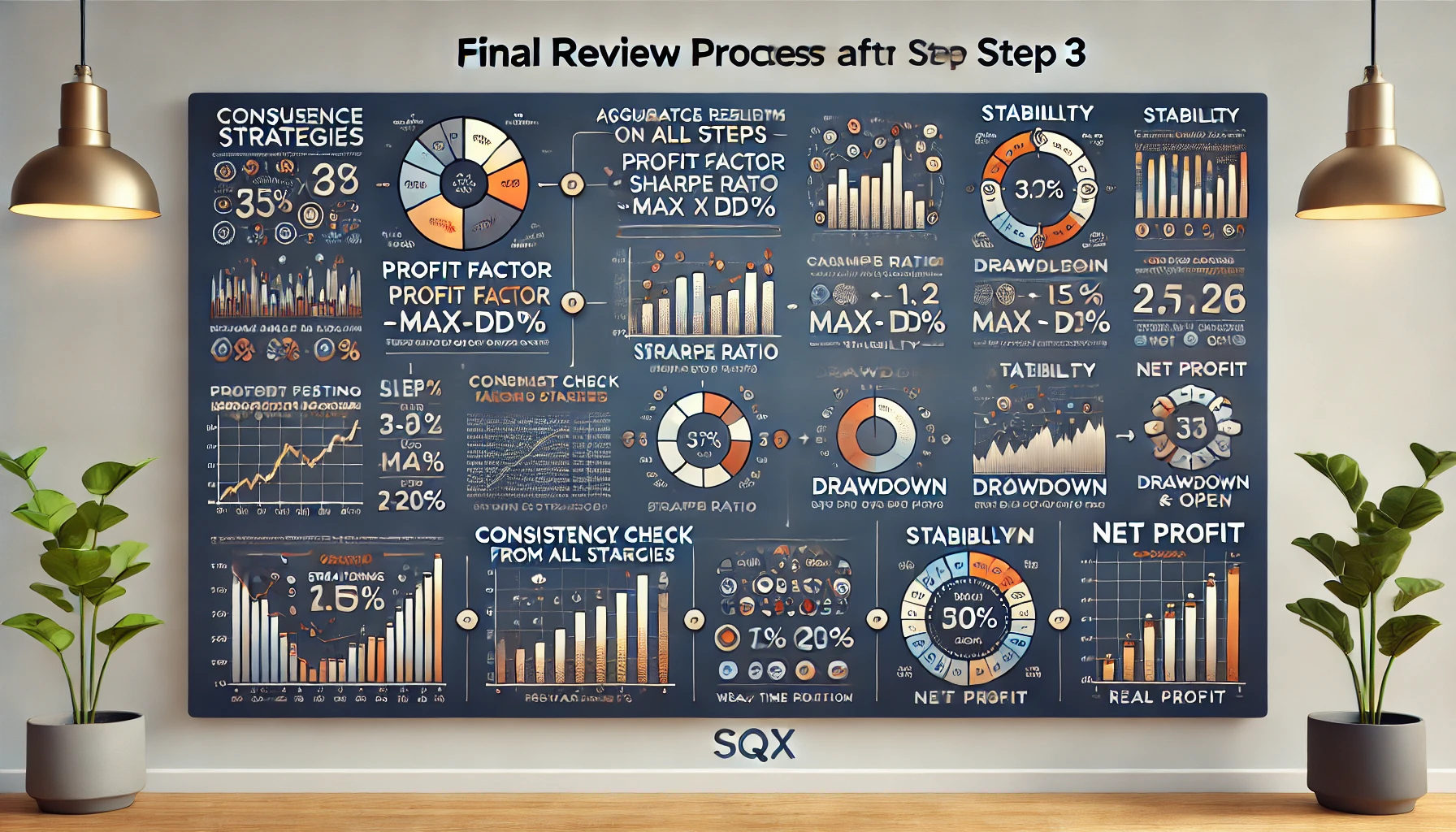

- Combine strategies in SQX Portfolio Master and analyze:

- Total return and drawdown.

- Sharpe ratio, MAR, profit factor.

- Combine strategies in SQX Portfolio Master and analyze:

- Apply Global Options:

- Ensure settings like “Exit on Friday” or “Limit Trading Range” make sense across all strategies.

- Monitor Overlap:

- Watch for overlapping trades that could inflate risk or strain account margin.

Example Scenarios

Scenario 1: Balanced Portfolio

- XAUUSD H1 (Trend-following).

- EURUSD M15 (Mean reversion).

- USDJPY H4 (Breakout).

- Outcome: Well-diversified, different strategies complement each other.

Scenario 2: Aggressive Scalping

- XAUUSD M15 (Scalping).

- GBPUSD M5 (Scalping).

- AUDUSD M15 (Scalping).

- Outcome: High trade frequency, suitable for high-volatility periods, but riskier due to correlation.

5. Tools to Support Mixed Portfolios

- Correlation Analysis Tools (available in SQX Portfolio Master).

- Monte Carlo Simulations: Stress-test portfolio robustness with random sequence variations.

- Walk-Forward Matrix: Ensure each strategy is robust independently before merging.

Key Advice

If what you’re doing aligns with these points—correlation analysis, managing global options, ensuring diversity—it’s on the right track. If you’re skipping global coherence checks or overloading similar strategies (e.g., scalping on correlated pairs), adjust your approach.