Your expert advisor (EA) test result shows impressive profitability but also highlights some significant areas of risk. Here's a detailed review:

Key Performance Metrics:

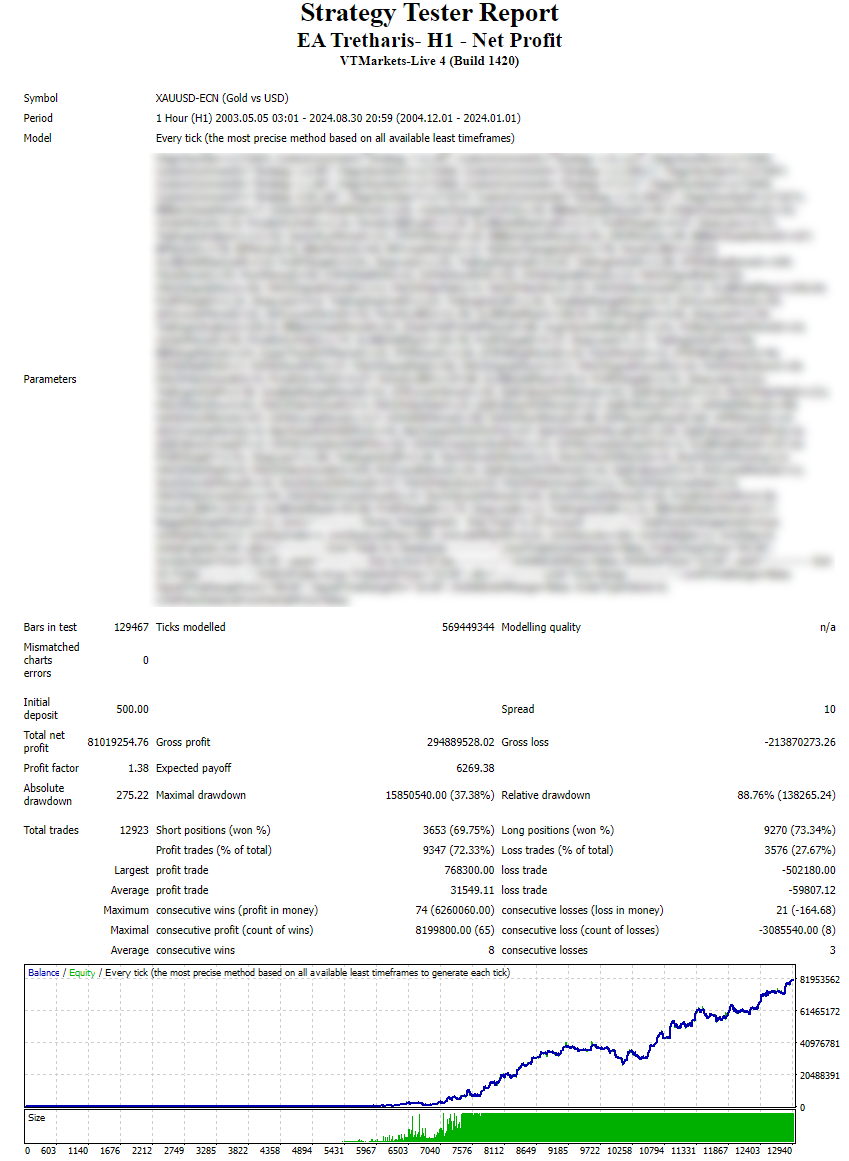

- Initial Deposit: $500

- Total Net Profit: $81,019,254.76

- Profit Factor: 1.38

- Total Trades: 12,923

- Win Rate:

- Short positions: 69.75%

- Long positions: 73.34%

- Largest Profit Trade: $768,300

- Largest Loss Trade: $502,180

- Average Profit Trade: $31,549.11

- Average Loss Trade: $59,807.12

- Maximal Drawdown: $15,850,540 (37.38%)

- Relative Drawdown: 88.76%

Positive Aspects:

- Profitability: A total net profit of over $81 million from an initial deposit of just $500 is outstanding, showcasing the EA’s potential.

- Win Rate: Your EA has a high win rate, with 72.33% of all trades being profitable. Both short and long positions have solid winning percentages.

- Profit Factor: At 1.38, the EA generates $1.38 of profit for every $1 of loss, which is decent though not exceptionally high.

- Expected Payoff: The expected payoff per trade is $6,269.38, which is very positive given the average profit trade is more than double the average loss trade.

Risk Concerns:

Drawdown Levels:

- Maximal Drawdown of 37.38% ($15.85 million) is very high. It means the strategy experienced a substantial loss relative to the account balance at some point, which could have been stressful to manage.

- Relative Drawdown of 88.76% suggests that at its worst, the account equity was reduced by almost 89%, which indicates an extremely high risk. This is critical since such deep drawdowns could lead to margin calls in live trading, and the account might not survive such fluctuations.

Risk/Reward Ratio:

- The average loss trade of $59,807.12 is almost double the average profit trade of $31,549.11, indicating a relatively poor risk/reward ratio. Larger losses could easily erode the account during losing streaks.

- The largest loss trade of $502,180 is significant, showing that large losses do occur.

Drawdown vs. Profit: Despite generating a large profit, the absolute drawdown is concerning. Losing nearly 89% of the equity at one point could indicate the need for tighter risk controls, especially given the EA's focus on high profitability.

Consecutive Losses and Gains:

- Maximum consecutive wins (74) and losses (21) seem manageable, but the maximal consecutive loss of $3,085,540 in 8 trades is alarming. This indicates that a series of bad trades could quickly wipe out a large portion of your capital.

Suggestions for Improvement:

- Risk Management: Consider improving the risk/reward ratio by using a better stop-loss mechanism or optimizing position sizes. The goal should be to reduce large losses and protect the account equity.

- Drawdown Control: Implement measures to reduce the drawdown, such as dynamic lot sizing, or adjust your risk per trade to avoid deep drawdowns that could jeopardize your account.

- Profit Factor: Aim to increase the profit factor to above 1.5 by improving entry/exit points, reducing the size of losing trades, and increasing profitability per trade.

- Trailing Stop or Break-Even Rules: Implement tighter trailing stops or break-even points to lock in profits earlier and avoid larger losses.

Overall, the EA's profitability is impressive, but the associated risks are extremely high. Refining risk controls could improve long-term viability.